How To Buy Stocks 2-7% Below Market Value Guaranteed!

Let me show you how to buy stock 2-7% below market value and at times even more.

It’s a favorite strategy of Warren Buffets also, so you are in good company if you choose to use it.

I love a good deal and I’m sure you do to, but how do we get a deal in the stock market?

Let me show you.

We get a deal by using a strategy called a Buy-Write your going to love this strategy if you have an interest in being paid upfront and buying a stock below its current market value.

So What Is a Buy-Write?

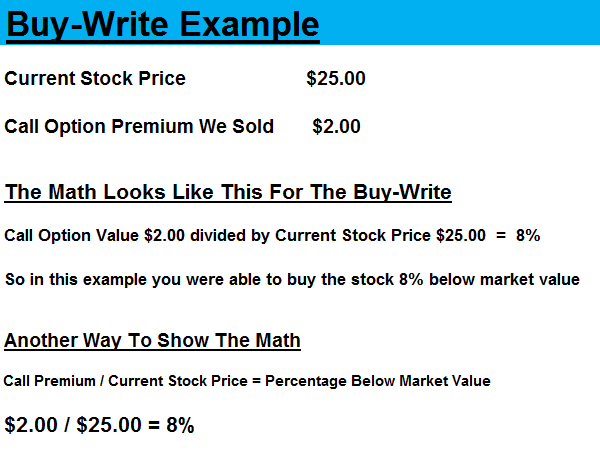

It’s the combination of purchasing a stock and selling a Call Option at the same time in a single transaction, let me put some numbers in an example to bring it to life for you.

I’m going to round the numbers in the example to make it easier to follow.

For this example we are going to assume a few things.

Current Stock Price – $25

Call Option Premium – $2

Not too bad we were able to buy the stock 8% below market value, now what happens.

What Happens Next

Well there are a couple of things that can happen next depending on the Strike Price of the Call Option you sold will depend on what happens next.

For this example we will assume a Strike Price for the call Option of $25.

This means if the stock is at or below $25 at the expiration of the Call Option you will be able to keep the stock and would have acquired it for $23 or 8% below the current market value at the time you acquired it.

If the stock is above $25 you will have the stock called away because the option you sold is ITM (In The Money), which means you simple made 8% return on the transaction.

Easier Than It sounds

This can sound a lot more complicated than it is at first, but is taking a little time to become familiar with this strategy worth the effort?

I think definitely yes, look at the benefits you either acquire the stock at a price significantly below the current market value or you get paid a premium if the stock gets called away when the option expired.

Pretty good deal in my book, 2 out of the 2 things that could happen and they are both positive for you, there are reasons Warren Buffet likes this strategy and they are the 2 big ones.

The Best Way To Use This Strategy

The best way for you to use this strategy is to find great quality stocks and ones that preferable have a catalyst for them to go up.

These make great candidates to execute the strategy on for 2 reasons.

- If the stock stays were it is you have been able to acquire it significantly below the current market value and make 8% return.

- If the stock only went up 1% in our example above or $25 you would have had the stock called away but you would have made an 8% return.

Ways To Improve It

There are 2 big ways you can improve this strategy and the returns you can make.

The first one is by picking great quality stocks, we do not have the room to cover that in this post but here are some ideas to think about.

Setting up a stock screener with criteria that is proven to find quality stocks that way with the press of a button you will have dozens if not more candidates to choose from in minutes.

The second biggest way to improve this strategy is the decision on what Call Option you decide to sell both the Strike price of the Option and also the Expiration date of the option.

Improvements like these can easily in some cases boost the potential returns to over 20% or more, again not enough room to cover everything here but definitely enough to get you thinking in the right direction.

I have also created a short video that shows you the process of How To Buy Stocks 2-7% Below Market Value and some extra tips on how to go about it.

Check Out The Video

I have also created a short video that shows you the process of How To Buy Stocks Below Market valued Guaranteed and some extra tips on how to go about it.

WATCH THE VIDEO

As always we would love to hear from you, so please comment below.

Remember to tell your friends about this page if you found it useful.