How To Turn Your Stock Portfolio Into A Cash Generating Machine!

Sounds like a great idea doesn’t it?

Let me assure you it is and by the end of this post you will know just how to do it.

We all know about this in the real estate business, you buy a house and rent it out, what is usually less known is that you can do almost the exact thing in the stock market when you own stock.

Interesting Isn’t It

I am going to keep the post focused on the result we are looking to achieve and also the numbers to help highlight the strategy in the examples.

I want to get across what a great strategy it can be and how it generally works without bogging down the post with too much technical jargon.

So with that in mind let’s meet your new Cash Generating Machine strategy the Covered Call.

Now some may have heard about this strategy before and if you have I hope you have been using it, but unfortunately as simple as the strategy is I often see it implemented the wrong way.

At the end of the post I will cover some ways to make sure you don’t.

So here’s how the covered call works, let’s say you own stock XYZ and you would like to generate some income off it, here’s what you would do.

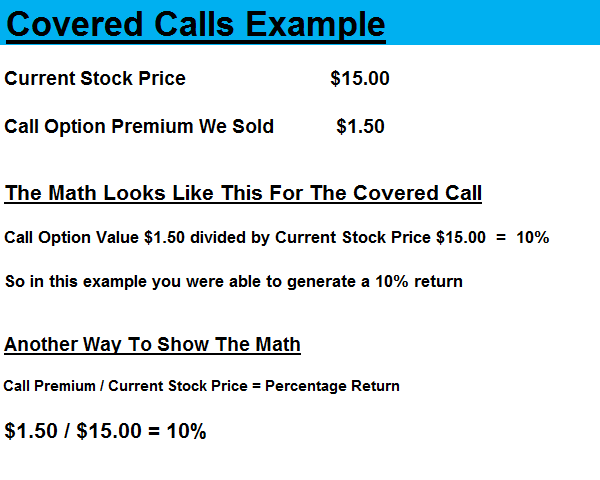

You would sell a call option against the stock you own, here’s some numbers to help.

For this example we are going to assume a few things.

Current Stock Price – $15

Call Option Premium – $1.50

Not too bad we were able to bring in 10% return in our example, now what happens.

What Happens Next

Well there are a couple of things that can happen next depending on the Strike Price of the Call Option you sold will depend on what happens next.

For this example we will assume a Strike Price for the Call Option of $15.

This means if the stock’s price is at or below $15 at the expiration of the Call Option you will keep your stock and pocket the 10% you made. Nice!

If the stock is above $15 you will have the stock called away and you will get to keep the premium you sold from the call option, so you will have made 10%. Nice again!

Of course if you wanted to keep the stock and not have it called away you would simple buy it back.

What Do You Do Now?

There are few things you could do, but let’s look at one.

So let’s say for example the stock went sideways or even down a little for several more months moving forward and stayed around the $15 price range and you kept selling Call Options each month and receiving $1.50 each time.

Original Month received $1.50

Month 2 received another $1.50

Month 3 received another $1.50

Month 4 received another $1.50

So in total you received $6.00 in Call Option Premiums.

So while everyone else who owned the stock has earnt nothing you are up $6.00 or 40% on a stock that has gone nowhere. I’d say that’s a pretty good deal.

And every month you sold the Call Options you received cash flow from selling the call options, let’s say you owned 1000 shares of XYZ stock you would have been earning $1,500 every time you did it.

The Best Way For You To Use This Strategy

The first is to simply start generating monthly income from the stocks you own, why have them just sit there and hope they will make you money when you can guarantee it?

There are half a dozen other ways this strategy can be used to make more money and reduce risks, but that’s for another post, just wanted to get the ball rolling for you here first.

There are also some great advanced ways to implement it also. Again another post.

How Successful Can You Be With This Strategy?

I know personally people who have taken this strategy of selling options and turned $100K into $30 million dollars in just a few years.

Now I’m not suggesting everyone will get those results, but it’s very encouraging and motivating to know people have.

That’s the power of what a great strategy implemented well and the power of compound interest coming together can do.

Will you always get 10% a month doing the strategy?

No you likely won’t but with the right selection of stocks and options sold you can often times get more.

Here’s Were Most People Go Wrong With This Strategy

- They sell the wrong call options.

- They pick the wrong time frames to sell them.

- They choose the wrong stocks to implement the strategy on.

- They just sell the Call Options for the highest price they can get.

- They sell the Call Option when there are not enough premiums received for doing it.

- They do not pay attention to the markets cycle and their stocks relation to it.

- Not taking the time to screen for the best candidates (this is huge).

Those are just some examples and ones I may explore in another post.

Check Out The Video

I have also created a short video that shows you the process of How To Turn Your Stock Portfolio Into A Cash Generating Machine and some extra tips on how to go about it.

As always we would love to hear from you, so please comment below.

Remember to tell your friends about this page if you found it useful.